trust capital gains tax rate 2020 table

The tax-free allowance for trusts is. Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020.

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041.

. It continues to be important. The following are some of the specific exclusions. Taxpayers with income below the 15 rate threshold below pay 0.

In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. This amount is taxed at that individuals marginal tax rate. Trust capital gains tax rate 2020 table Saturday March 19 2022 Edit.

More than one year. The maximum tax rate for long-term capital gains and qualified dividends is. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

18 and 28 tax rates for individuals. The trustees take the losses away from the gains leaving no chargeable gains for the. Events that trigger a disposal include a sale donation exchange loss death and emigration.

Its also worth noting that if youre on the cusp of. They would apply to the tax return filed in. So a decedent dying between Jan.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. 2021 Long-Term Capital Gains Trust Tax Rates. Additionally the 38 Obama-care surtax kicks in at that same top level.

2020 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa. 45 x R64 00000. The Internal Revenue Service recently published its annual inflation-adjusted figures for 2020 for estate and trust income tax brackets as well as the exemption amounts for.

2022 Long-Term Capital Gains Trust Tax Rates. 10 and 20 tax rates for individuals not including residential property and carried interest. By Soutry Smith Income Tax.

Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. Trusts and estates pay capital.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. 2020 Federal Income Tax Brackets and Rates.

The following Capital Gains Tax rates apply. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. With trust tax rates hitting 37 at only 12500 its not good to pay taxes out of a trust.

The following are the income thresholds for 15 and 20 rates. South Africa 2020 Tax Tables for Companies. Irrevocable trusts are very different from revocable trusts in the way they are taxed.

40 of R160 00000 is included in the taxable income of the individual. In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. 2021 Long-Term Capital Gains Trust Tax Rates.

In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000. The new tax rates for year 2019 announced There is slight increase in the Estate Tax Exclusion amount in this year.

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Can Capital Gains Be Distributed To The Beneficiary Yeo And Yeo

Understanding Charitable Remainder Trusts

Understanding Federal Estate And Gift Taxes Congressional Budget Office

What You Need To Know About Capital Gains Tax

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

The Tax Impact Of The Long Term Capital Gains Bump Zone

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

2021 Tax Rates And Exemption Amounts For Estates And Trusts Preservation Family Wealth Protection Planning

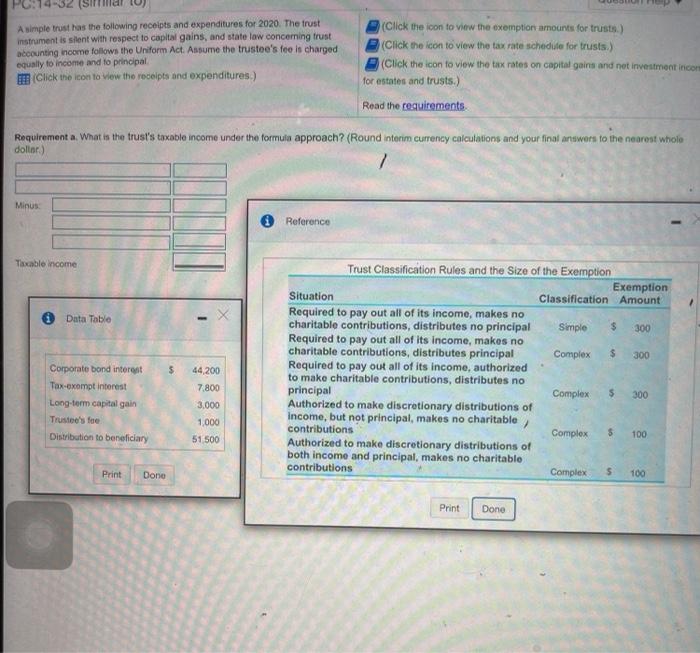

Question Help Pc 14 32 Similar To A Simple Trust As Chegg Com

State Corporate Income Tax Rates And Brackets For 2020

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities